If you’ve got a poor credit history, finding a lender who you can trust and that will trust you can be difficult. Even more so if you’re looking for RV financing.

When a poor credit score is holding you back, one of the few options available for financing is personal loans. This type of loan is given unsecured – the borrower doesn’t put any property up as collateral. They can be as low as $100 and higher than $30,000.

A personal loan typically has interest rates higher than your average secured loan, and missing a payment can lead to your RV being repossessed and an even more devastating mark on your credit. It is vital that you make your payment on time, every time.

We’ve found three companies that are offering loans for your new RV no matter your previous financial issues.

Bad Credit RV Loans

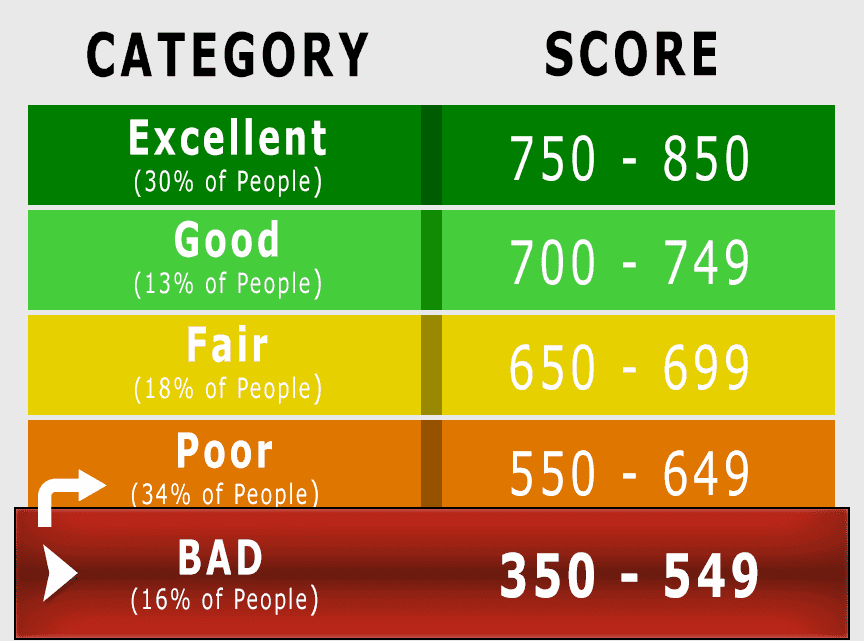

Finding an RV loan with 620 credit score or lower can be nearly impossible. When looking for bad credit camper loans, it’s important to keep a few things in mind.

Most loans in this situation are going to be unsecured – meaning the lender isn’t taking collateral against the loan. The loan amount and the interest rate can both vary widely, depending on the lending agreement. Unsecured loans can be used for home improvement, travel, or many other uses.

When the contract is signed, the lender agrees to give the borrower a lump sum of money in exchange for pre-determined monthly or bimonthly payments. These installments are a percent of the original lump sum, plus interest.

Some lenders will have prepayment penalties, so always be sure to read the entirety of your loan agreement before signing.

How To Buy An RV With Bad Credit – 3 Lender Aggregators

1. AutoLoanZoom

This is our number one choice. AutoLoanZoom.com is a loan aggregator that matches you with a lender and dealer from your local area. Even if you’re in the middle of filing a bankruptcy, AutoLoanZoom will do their best to help you find a loan on RV.

This aggregator doesn’t lend you the money themselves, but rather will connect you with one of their many networked partners. The website is available fee-free in every state to help you find the one right for you.

Before you apply, have the following documents ready:

- Social Security Number

- Monthly Income Proof

- Monthly Housing Payment Proof

To apply, simply visit their website and fill our their form. You have to be at least 18 years or older, have a regular source of income, and be a US Citizen or permanent resident. Many loans require you to have a bank account as well.

Once you’ve filled in the form, they will seek out a lender and dealership that will work for you. Note that as Auto Loan Zoom is not a lender itself, there may be additional requirements imposed by the lender. Always read the terms of the agreement before signing.

2. Lending For Bad Credit

Lending For Bad Credit was founded in 2012 and offers quick service, with next day deposit on loans. They know how difficult building good credit can be when you’ve been unlucky in the past.

Filling in their form takes two minutes or less, then your information is sent out to their network to find a lender that fits for you.

You must be at least 18 years of age or older, have a regular source of income, and be a US Citizen or permanent resident to use this website. Lending For Bad Credit is not a lender itself, there may be additional requirements imposed by the lender. Always read the terms of your agreement before signing.

3. 24/7 Auto Finance

With a network spanning coast to coast, 24/7 Auto Finance is ready to do the hard work for you. They know how difficult it can be trying to work your way out of a poor credit history. This company is ready to connect you with any one of their many networked partners who will work with you.

As with the others, you must be at least 18 years of age or older, maintain a regular source of income (at least $1,500 monthly), and be a US Citizen or permanent resident.

If you meet these requirements, simply fill out their form. They’ll send your information out to their network and find a lender that works for you.

24/7 Auto Finance is not a lender itself, there may be additional requirements imposed by the lender. Always read the terms of the agreement before signing.

Financing Options For RV Loans With Bad Credit

Poor credit isn’t the end of the road for your RV dreams. It certainly isn’t ideal, but it IS possible to find a loan for RV or travel trailers.

Another option that you can use is a home equity loan. In this type, the bank (or other lender) would use your house as collateral. If you don’t make every payment – they could be entitled to your house.

It’s best to avoid auto title loans for your RV – in most cases, it simply won’t be enough. Don’t be tempted to use these to get enough funds for a down payment – it isn’t worth it.

If you don’t want to go through the trouble of navigating through all the different options, let AutoLoanZoom do the work for you. Just fill in their quick online form, they’ll send your information throughout their network to help you find what you’re looking for.

You must be 18 years of age or older with full-time employment and a US Citizen or permanent resident. Always make sure you read and understand the agreement before signing.

How To Calculate RV Loan

When searching for camper financing with bad credit, you need to know how to calculate what you’ll be paying in interest.

This formula is specifically for amortizing loans – ones that apply a portion of your payment towards both balance and interest. Note that this does NOT calculate the amount of your payment.

- ((APR) / (Payments Per Year)) x (Current Loan Balance) = (Interest Payment)

EXAMPLE

In this example, the starting balance is $20,000 with an APR of 5%. It has a 5 year term with a payment every month.

- (0.05) / (12) = (0.004) – Interest Rate divided by amount of Payment Installations Per Year.

- (0.004) x $20,000 = $80 – The answer from above multiplied by the current balance.

Now – that $80 is only going towards the interest payment, not towards the $20,000 balance. Let’s go a little further and say that you made an overall payment of $250.

- $250 – $80 = $170

- $20,000-$170 = $19,830

This means that $170 went towards the balance and $80 went in interest to the lender. These calculations are done every payment cycle, slowly reducing both the amount of interest paid and the balance.

If you paid $250 the following month, the interest payment would be $79.32 and the rest would be applied to the balance.

Finding An RV With Poor Credit

Now that you’ve got a plan in mind – you need to find an RV. Since you already know that you’re starting from a poor position, there are a few things to do.

Gather as much money as you can for a down payment. The more you pay in that initial lump sum, the less interest you will end up paying over the life of the agreement.

Before you approach the dealer, check your credit profile with the three major reporting agencies. This can give you an idea ahead of time on what your position is before you visit the dealership.

600 and up is generally considered good. Anything below that can make lenders hesitant.

Alternatively, check out Auto Loan Zoom. They match you with both lenders and dealers to help you find that one RV that will take you on your next adventure. Even with this option, though – make sure you’ve got as large of a down payment as you can afford.

Building Good Credit

Once you’ve got your financial plan established, you need to follow a few simple rules to make sure you’re building a good financial history.

Make every payment on time. This is vital to keeping your RV avoiding the troubles that put you here in the first place. If you’re going to have trouble making a payment, call your lender. Most of the time, they will work with you if you’re experiencing a temporary setback or hardship. They want you to finish paying – it’s in everyone’s best interest.

In the meantime, do not apply for any additional loans or credit cards. Doing so will be noted by the reporting agencies, which could lower your credit score.

Don’t close or cancel any of your cards either. When you close a credit card, it often comes at a cost to your credit score.

Last – make sure you read the documentation and understand the terms prior to signing. This last rule is an extremely important one to follow in all areas of contract signing – not just where good credit is concerned.

Wrapping Up

If you’re looking for bad credit trailer loans or RV loans, you’ve probably looked at all the banks and credit unions in your area twice over. Even if you’ve been turned down and are filing bankruptcy, there might still an option for you.

We’ve reviewed three lender aggregators who want to help you achieve your dream of adventure. Auto Loan Zoom came out on top. The lender they match you with might have strict conditions, but they will help you take another shot.

By always reading and understanding the documentation fully before signing, you can find a loan that’s right for you. Your adventure can start and you can be in the motorhome of your dreams. See our related post on guaranteed RV financing. Read also our guide on the best time of year to buy an RV.

This blog article is copyrighted. All rights reserved.

stayontrails

Latest posts by stayontrails (see all)

- How To Bike Uphill Without Getting Tired - May 12, 2022